As Budgeting for Home Automation: Smart Tips for BeginnersThe Role of Financial Planning in Work-Life BalanceCheap Small Business Insurance That Doesn’t Cut Corners takes center stage, this opening passage beckons readers with casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

In the realm of home automation, financial planning, and small business insurance, there lies a wealth of information waiting to be explored and understood.

Budgeting for Home Automation

Setting a budget for home automation projects is essential to ensure that you are able to implement the smart features you desire within your financial constraints. By planning ahead and allocating funds accordingly, you can avoid overspending and make the most out of your investment in home automation.

Cost-Effective Smart Home Devices for Beginners

- Smart plugs: These affordable devices allow you to control your appliances remotely and save energy by scheduling their usage.

- Smart bulbs: Upgrade your lighting system with cost-effective smart bulbs that offer features like dimming and color-changing options.

- Smart thermostats: Invest in a smart thermostat to regulate your home's temperature efficiently and reduce energy costs.

Prioritizing Automation Needs Within a Budget

When working within a budget for home automation, it's important to prioritize your needs to make the most of your investment. Start by identifying the areas of your home that would benefit the most from automation and focus on those first.

You can always expand your smart home system gradually as your budget allows.

The Role of Financial Planning in Work-Life Balance

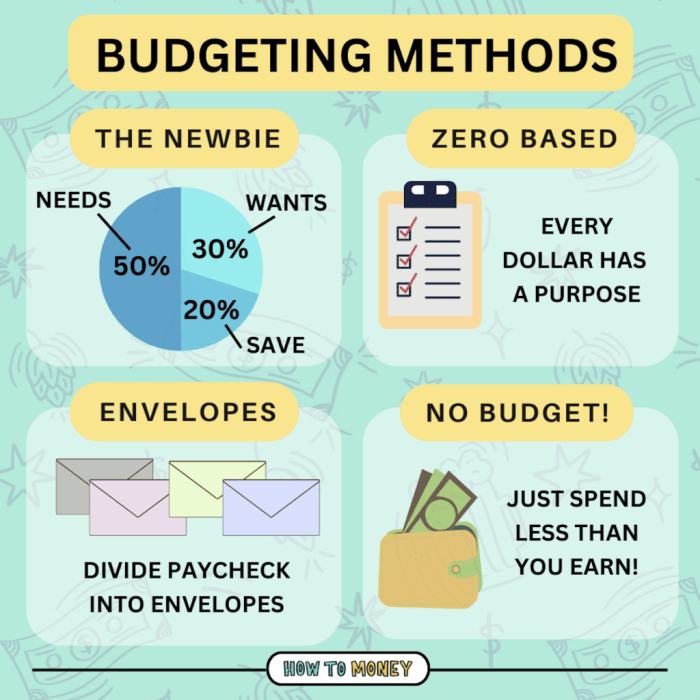

Financial planning plays a crucial role in achieving a healthy work-life balance by helping individuals manage their finances efficiently, reduce stress, and focus on personal well-being.

Reducing Stress and Improving Well-being

- Creating a budget can provide a sense of control over finances, reducing anxiety about money-related issues.

- Setting financial goals and working towards them can increase motivation and overall satisfaction with life.

- Having an emergency fund in place can offer peace of mind during unexpected financial challenges.

Integrating Financial Planning into Daily Routines

- Allocate time each month to review your budget and track expenses to ensure you are on target with your financial goals.

- Automate bill payments and savings contributions to streamline financial tasks and reduce the mental burden of managing finances.

- Regularly reassess your financial goals and adjust your budget as needed to align with your changing priorities.

Cheap Small Business Insurance That Doesn’t Cut Corners

When it comes to running a small business, having the right insurance coverage is crucial for protecting your assets and operations

Here, we will discuss the importance of insurance for small businesses, key factors to consider when looking for affordable small business insurance, and how skimping on coverage can harm your business.

The Importance of Insurance for Small Businesses

Insurance plays a critical role in safeguarding your small business against risks and liabilities. Whether it's property damage, lawsuits, employee injuries, or other unforeseen events, having the right insurance coverage can provide financial protection and peace of mind.

Key Factors to Consider for Affordable Small Business Insurance

- Assess Your Risks: Identify the specific risks your business faces to determine the type and amount of coverage you need.

- Shop Around: Compare quotes from multiple insurance providers to find the best coverage at a competitive price.

- Bundling Policies: Consider bundling different types of insurance (e.g., general liability, property, workers' compensation) with the same provider for potential discounts.

- Review Coverage Limits: Make sure your insurance policy covers your business's unique needs and adjust coverage limits accordingly.

- Consider Deductibles: Choose deductibles that align with your budget while ensuring you can afford out-of-pocket expenses in case of a claim.

The Detrimental Effects of Cutting Corners on Insurance

Trying to save money by skimping on insurance coverage can have severe consequences for your small business. Inadequate coverage may leave you vulnerable to financial losses, lawsuits, and even the risk of shutting down your operations due to unforeseen events.

It's essential to strike a balance between cost and coverage to protect your business effectively.

Concluding Remarks

As we conclude this journey through Budgeting for Home Automation: Smart Tips for BeginnersThe Role of Financial Planning in Work-Life BalanceCheap Small Business Insurance That Doesn’t Cut Corners, it's evident that a balanced approach to managing finances and investments is crucial for a secure future.

Q&A

What are some cost-effective smart home devices suitable for beginners?

Some cost-effective options include smart plugs, smart light bulbs, and smart thermostats which offer great value for beginners.

How can financial planning improve work-life balance?

Financial planning can reduce stress by providing a clear roadmap for managing expenses and savings, allowing individuals to focus on their personal and professional lives with greater peace of mind.

Why is insurance important for small businesses?

Insurance safeguards small businesses against unexpected events like liability claims, property damage, or lawsuits, providing financial protection and peace of mind.

What are the key factors to consider when looking for affordable small business insurance?

Key factors include coverage options, premiums, deductibles, and the reputation of the insurance provider, ensuring that the chosen policy meets the business's needs without breaking the bank.

How can cutting corners on insurance impact a small business?

Cutting corners on insurance can leave a small business vulnerable to significant financial losses in case of unforeseen events, potentially jeopardizing its operations and long-term viability.